The Purple Ocean: Unlocking the Trillion-Dollar Nexus of Industry, Startups, and Impact

The era of choosing between industrial scale and startup speed is over.

For decades, value creation has been divided into two distinct worlds.

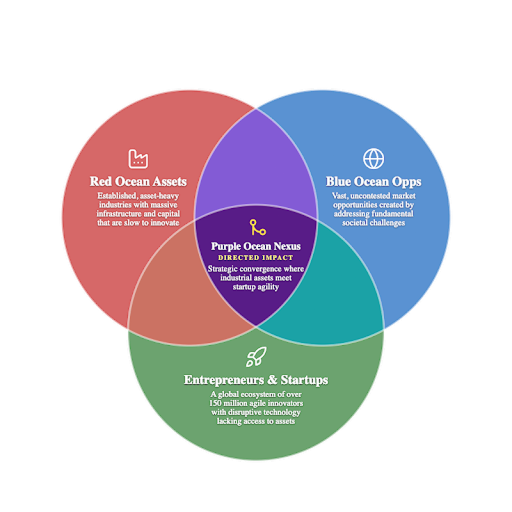

On one side lie the Red Ocean: the massive, asset-heavy industries like maritime, energy, and agri-food that underpin the global economy. They possess the infrastructure, the capital, and the customers, but they are often constrained by legacy systems and risk aversion.

On the other side lies the Blue Ocean: the massive untapped market opportunities defined by addressing fundamental societal challenges and new market segments, but where the challenge lies in identifying them (Kim & Mauborgne, 2005).

Currently, this divide creates a blind spot. In the Red Ocean, delivering environmental impact is often viewed as a compliance cost, a necessity rather than a driver of value. Meanwhile, Blue Ocean impact investments and philanthropic initiatives are often disconnected from the industrial assets required to scale them.

This separation is a market failure.

History warns us of the cost of this separation. Consider the German energy giants RWE and E.ON, who possessed the grid connections and capital to lead the renewable transition but clung to legacy coal and nuclear assets. This inertia was catastrophic: by 2015, E.ON posted a record loss of €3.16 billion, and RWE admitted that a third of its power stations were failing to cover operating costs, forcing a painful restructuring of the entire sector. Conversely, look to Better Place, the EV pioneer that collapsed after burning nearly $1 billion because it tried to build heavy infrastructure from scratch rather than partnering with existing utilities.

These were not just business failures; they were structural warnings. They demonstrate that "Red Ocean" incumbents face obsolescence when they close their doors to the "Swarm," while "Blue Ocean" visionaries drown when they attempt to replicate industrial assets alone.

To solve the exponential urgency of global resource and environmental crises, we cannot rely on incremental changes in the Red Ocean or isolated bets in the startup ecosystem. We need a new topography.

We call this the Purple Ocean. Building on the academic concept of hybrid strategies that integrate radical and gradual innovation (Gandellini & Venanzi, 2011), we define the Purple Ocean as the nexus where solutions are delivered by The Swarm, a global ecosystem of over 150 million startups and innovators. They possess the agility, the disruptive technology, and the hunger to solve problems, but they lack the access to the physical assets required to validate and scale their solutions.

These forces are not cyclical. They are structural — and they are reshaping the economics, incentives, and operating realities of food production and water systems far faster than traditional industry models can adapt.

Defining the Purple Ocean: Where Assets Meet the Swarm

The Purple Ocean is not just a metaphor; it is a structural innovation strategy. It is the Nexus where the Red Ocean of industrial assets converges with the Blue Ocean of directed innovation. Here, the goal is not just to find uncontested markets, but to solve structural inevitabilities. Transforming environmental impact into industrial advantage powered by the directed innovation of "The Swarm".

The traditional "Blue Ocean" strategy focuses on finding open markets. Purple Ocean strategy focuses on building them.

It works by identifying Innovation Theses, a combination of fundamental societal challenges combined with the industrial assets and the technologies available to solve them:

The Industrial Bridge (The Moat): Leveraging the Red Ocean assets (ships, retail stores, land). This is the Hardware Layer. It's expensive, slow to build, and provides a massive barrier to entry.

The Digital Bridge (The Engine): The Platform & Application Layer (AI, big data, cloud). This is the "fast path" that unlocks the asset, creates the customer experience, and captures the high-margin, intangible value.

Strategic Inputs (The Context): UN SDGs, Planetary Boundaries Framework, market data, environmental data, and industrial challenges (underutilisation, inefficiencies)

Once the Innovation Theses are defined and tested with corporate partners, we identify the innovators from the swarm that are best suited to solve the challenges.

This is Directed Innovation. Instead of betting on random startups, we systematically process the global funnel to identify the top 0.1% of innovators and map them directly to the structural inevitabilities facing essential industries.

The Unifying Framework: Innovation as a System

The Purple Ocean is not a standalone initiative; it is the unifying concept that sits at the top of the Investigate ecosystem, directing the flow of intelligence and capital.

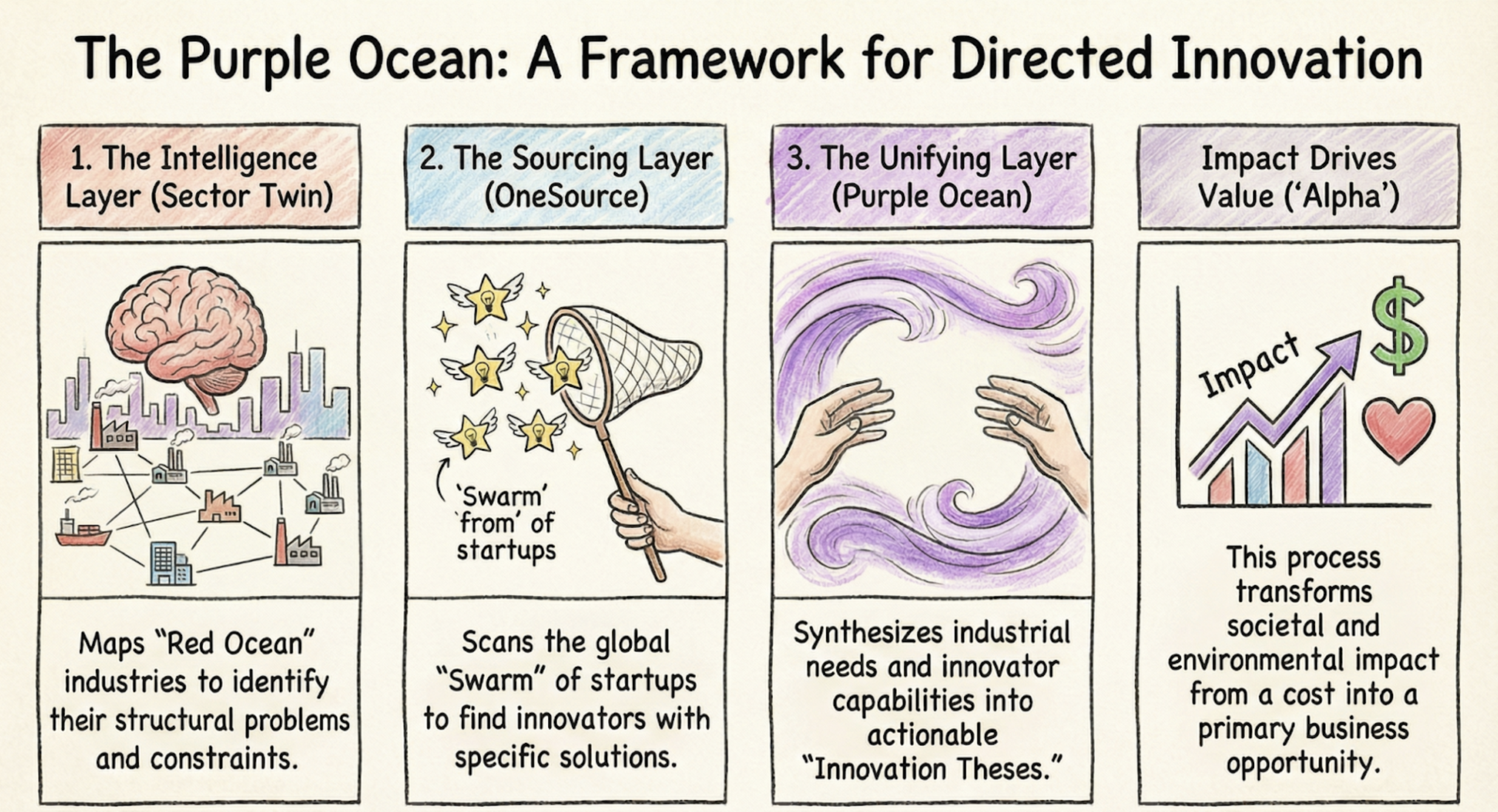

To generate value, you need more than just a thesis. You need an architecture that turns information into direction. This is how our ecosystem functions as a solution stack:

1. The Intelligence Layer (Sector Twin) Before we can innovate, we must understand the constraints. The Sector Twins are data-driven models of entire sectors that provide system level understanding. They reveal the conditions that will inevitably produce new innovation, giving structural advantage to where and when to invest. It tells us where the problem is.

2. The Sourcing Layer (OneSource) Once the constraints are mapped, OneSource filters the global noise. It is an Investigate product that scans the "Swarm" of startups to identify the specific innovators capable of solving that constraint. It tells us who has the solution.

3. The Unifying Layer (Purple Ocean) Purple Ocean sits above these layers, synthesizing the industrial constraints from Sector Twin with the innovator capabilities from OneSource. It acts as the Impact Nexus, generating the innovation theses that combine corporate assets with startup speed.

Impact is No Longer a "Necessary Evil"—It is Alpha

For too long, large corporations have viewed global impact as a compliance cost or a necessary evil.

The Purple Ocean framework inverts this logic.

It treats planetary boundaries not as constraints, but as demand signals. By identifying opportunity spaces where societal challenges intersect with industrial assets, we transform impact into the primary driver of enterprise value.

When a shipping giant opens its fleet to a fuel-efficiency startup, it isn't just cutting emissions, it is unlocking a new, high-margin efficiency layer.

When an energy utility partners with a decentralized grid innovator, it isn't just stabilizing the network, it is capturing the captive demand of the AI era.

The future belongs to those who can bridge the divide.

The Purple Ocean is the mechanism to run thousands of low-cost options in parallel to find the global maxima. It is the way we turn the "Swarm" into a directed force for global impact and industrial renewal.

The assets are ready. The Swarm is waiting. It is time to enter the Purple Ocean.