Where the Next Billion-Dollar Startups Will Emerge

The global Agri-Food system — and the essential infrastructure that supports fresh water supply — are entering the most consequential transformation in decades

For generations, both sectors were defined by stability:

Agriculture evolved gradually.

Yields improved incrementally.

Fresh water was abundant and inexpensive in developed markets.

Supply chains scaled predictably.

Innovation occurred at the margins.

That era is over!

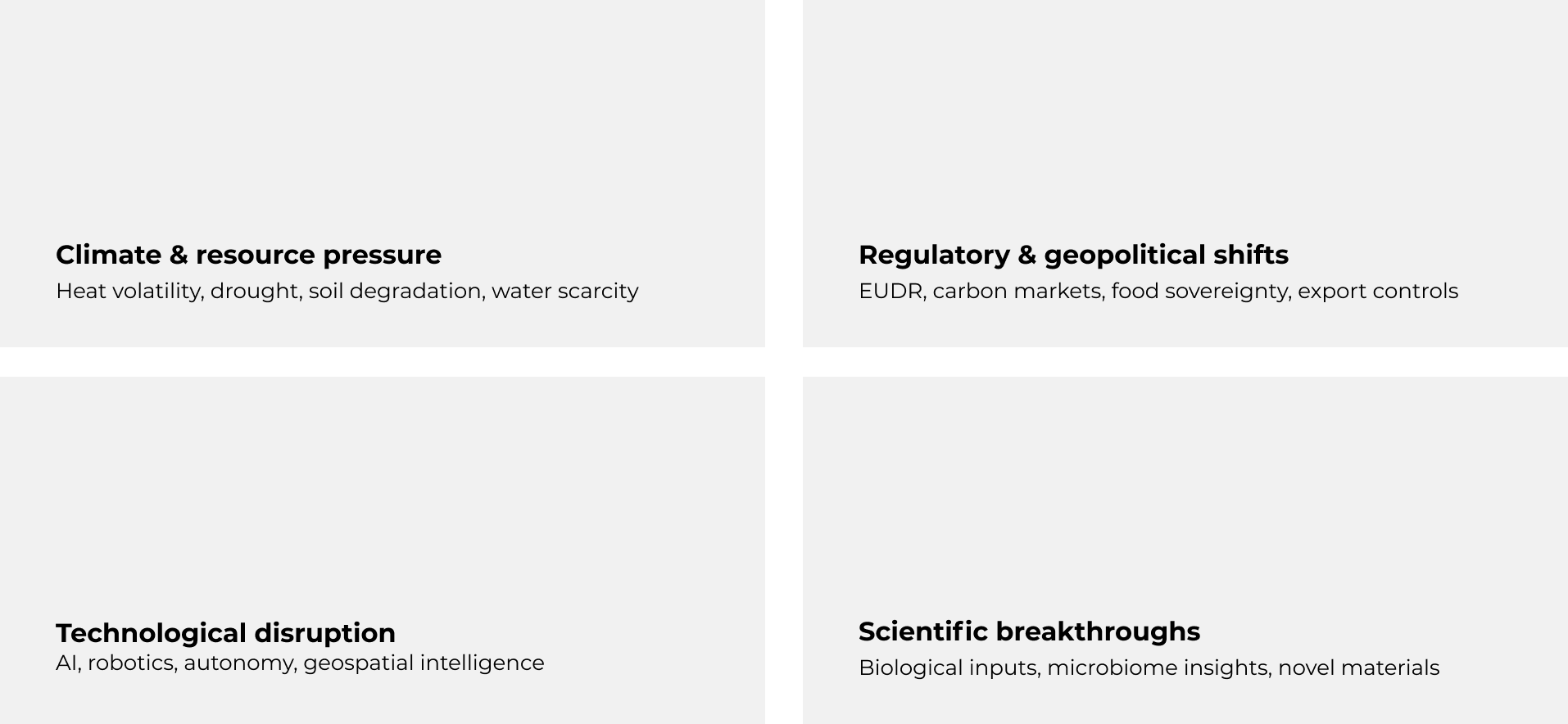

Today, Agri-Food and Water sit at the intersection of four accelerating structural forces — highlighted across recent analyses from McKinsey, Deloitte, the FAO, and the World Economic Forum:

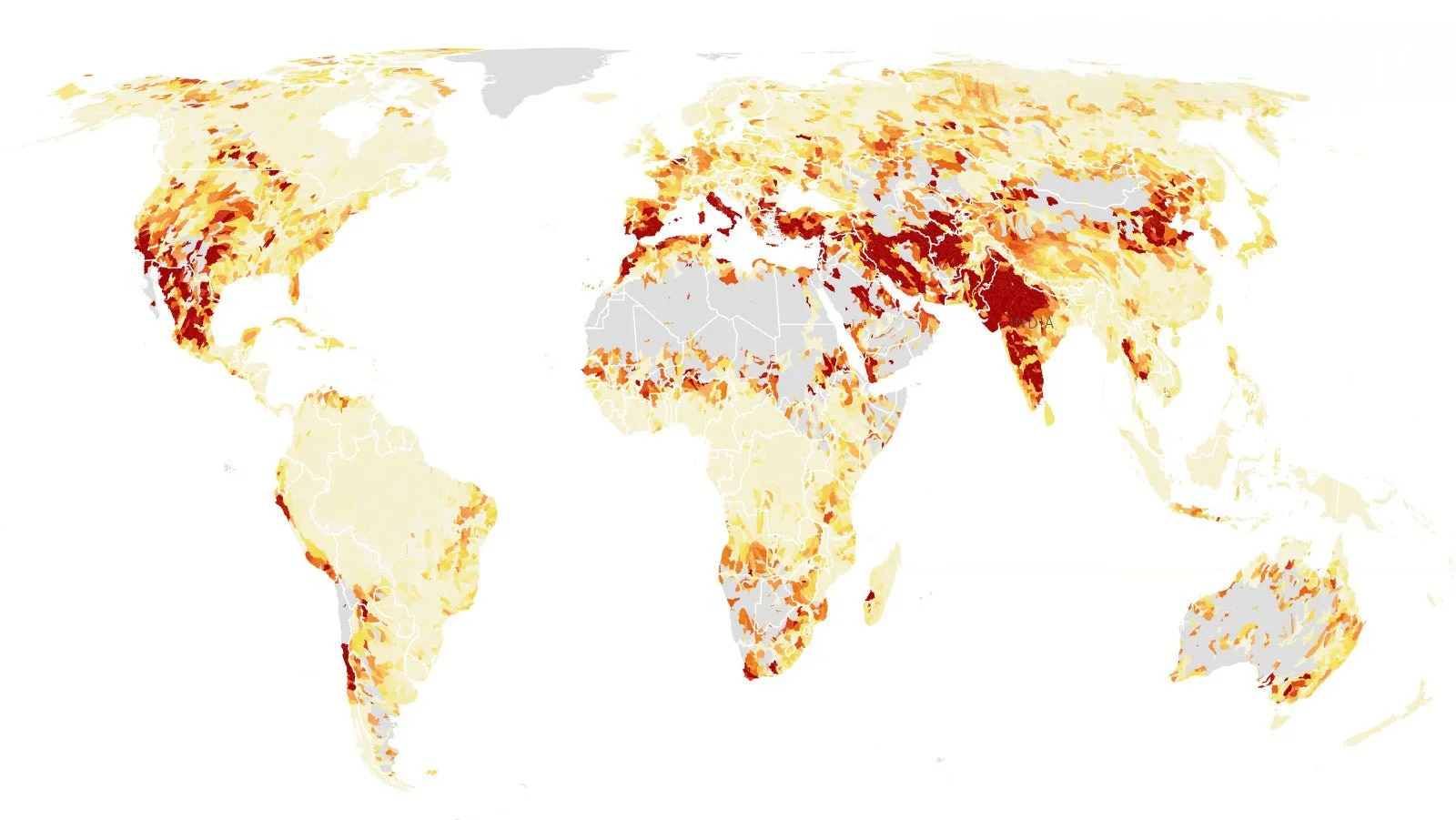

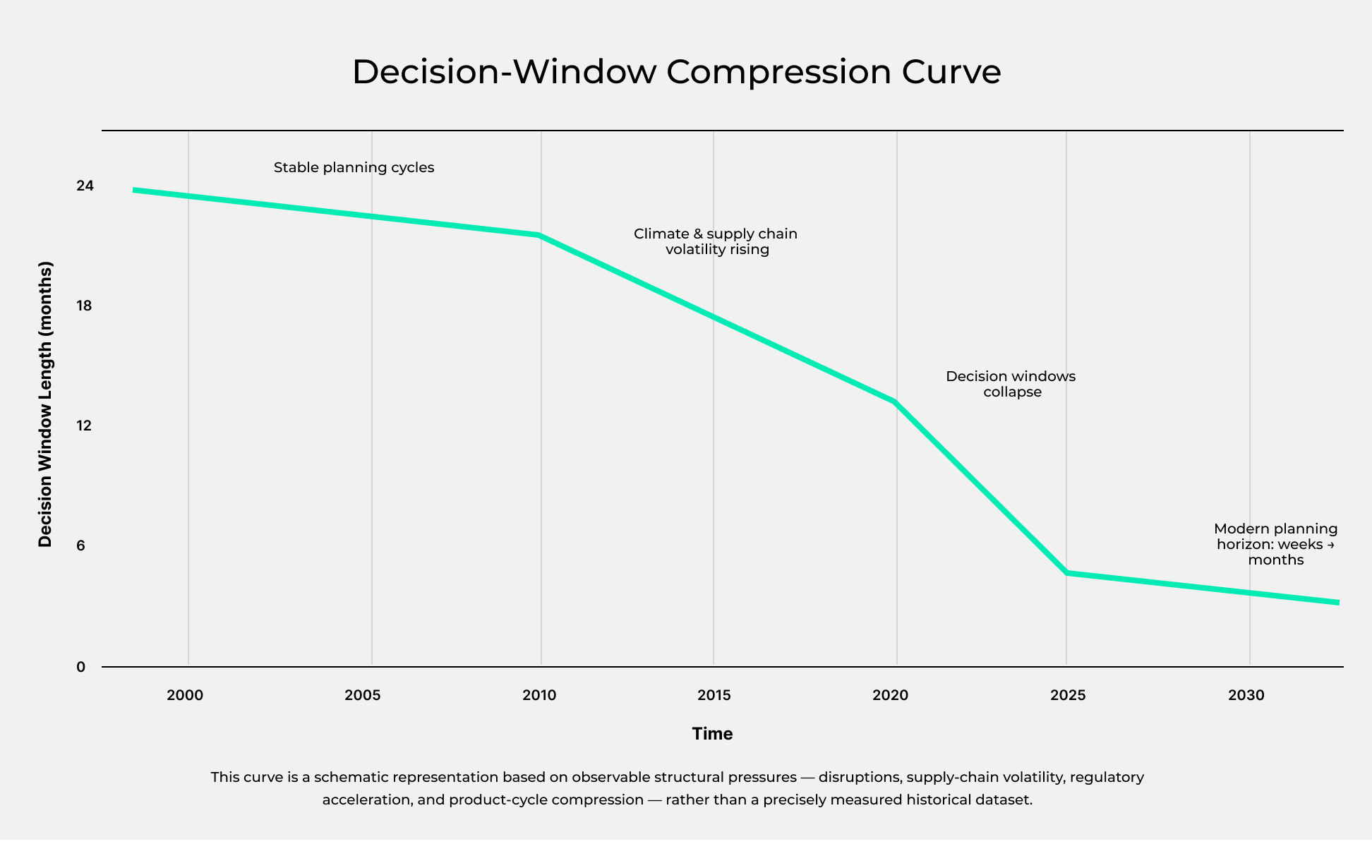

The World Economic Forum continues to rank water scarcity and food insecurity among the top global risks of the decade. The World Bank projects a 40% gap between freshwater demand and supply by 2030. McKinsey shows that climate volatility is compressing the decision-making window for food and water systems faster than at any point in modern history.

Water scarcity and food insecurity rank among the top global risks of the next decade.

Source: WRI Aqueduct, 26.1.2020

These forces are not cyclical. They are structural — and they are reshaping the economics, incentives, and operating realities of food production and water systems far faster than traditional industry models can adapt.

From our analysis, one insight is clear

“The startups that will define the next decade of Agri-Food and Water have not been founded yet — and those created between 2025 and 2027 will reach unicorn scale in less than five years. ”

This shift is predictable. It is driven by necessity. And it is creating entirely new categories of opportunity.

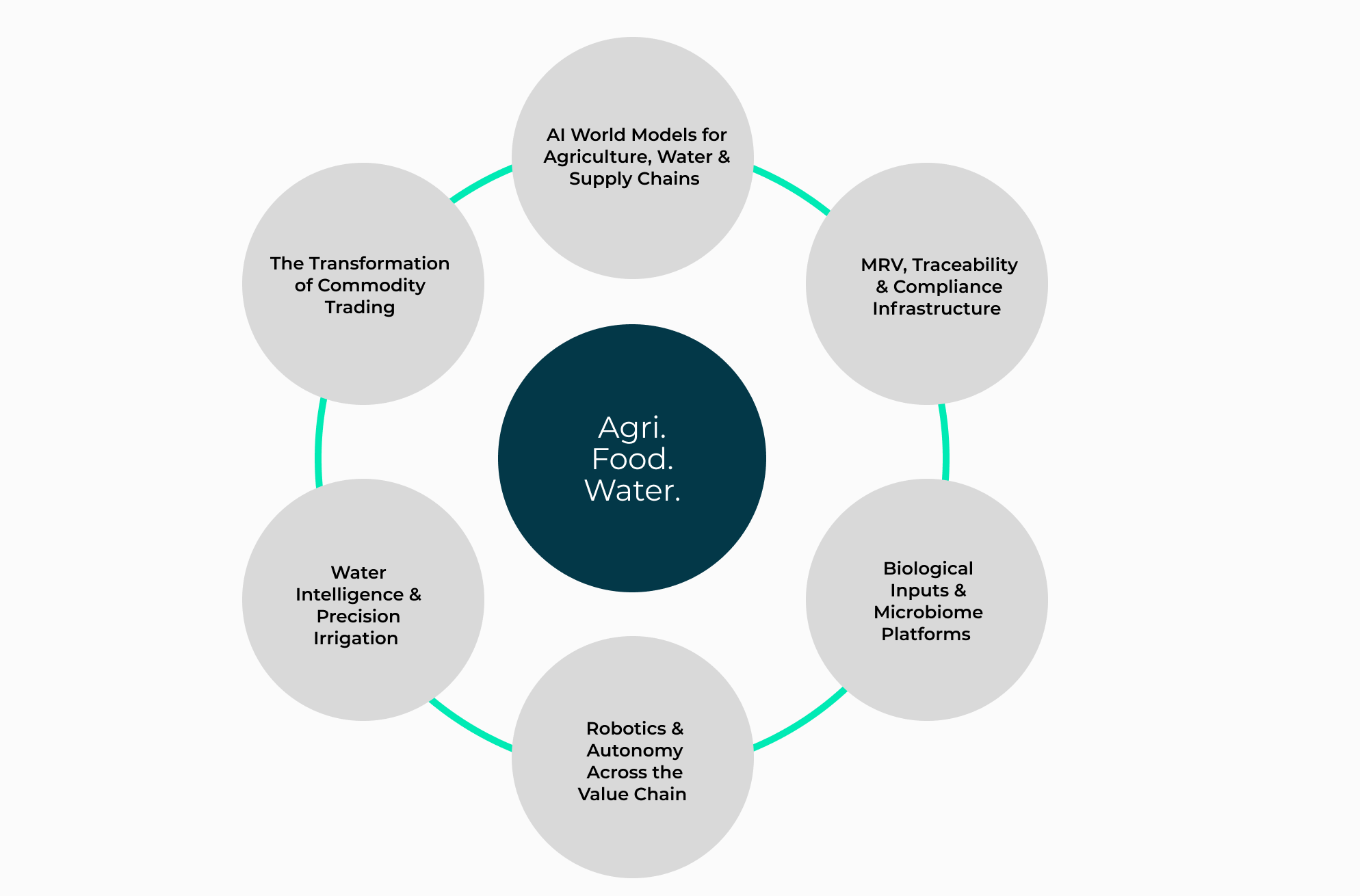

Six Structural Opportunity Zones in Agri-Food & Water

These opportunity zones represent structural inevitabilities, not trends. They emerge from the way the Agri-Food and Water systems are being rebuilt in real time.

-

Global consultancies and research bodies consistently identify climate volatility, water scarcity, and supply-chain fragility as leading systemic risks — and that convergence demands a shared intelligence layer.

Agri-Food and Water systems are shifting toward whole-system world models that combine:

satellite & climate models

agronomic & hydrological models

logistics & risk analytics

scenario simulation environments

This will become core infrastructure for:

farmers

water utilities

processors

retailers

insurers

traders

policymakers

-

Deloitte’s regulatory outlooks highlight that Agri-Food will face more regulatory transition in the next five years than in the previous twenty — making compliance infrastructure one of the most investable categories.

Next-generation platforms will enable:

carbon & biodiversity MRV

water-use verification

provenance & sustainability tracking

food safety and contamination tracing

digital product passports

Why this is inevitable:

Regulation and market access are converging.

No data → no trade. -

Global research bodies, including FAO and leading agronomy institutions, confirm a structural shift away from synthetic inputs toward biologicals.

Breakthrough platforms will integrate:

field-level performance data

adaptive biological formulations

microbiome ecosystem insights

Why this is inevitable:

Soil health challenges, regulatory constraints, and rising synthetic costs are pushing biological adoption far beyond historic projections. text goes here -

Labour scarcity and climate unpredictability — documented by USDA, FAO, and multiple industry reports — are making autonomy non-optional.

Innovation will accelerate in:

autonomous tractors

robotic harvesting

precision spraying

automated sorting & packhouses

Why this is inevitable:

Labour shortages are permanent across major Agri-Food regions, and automation economics are improving rapidly. -

Water scarcity is no longer a regional issue — it is a global structural constraint.

WEF, OECD, and the World Bank all point to freshwater pressure as one of the defining systemic risks of the 2025–2035 period.High-impact innovation will include:

predictive irrigation

integrated water monitoring

water-quality analytics

drought-response modeling

Why this is inevitable:

Agriculture uses 70% of global freshwater withdrawals — and without water intelligence, yield stability cannot be maintained. -

Item Commodity markets — especially food and water-adjacent commodities — are entering the biggest structural reset in their modern history.

New platforms will enable:

full-chain provenance

transparent production cost and volume visibility

fewer intermediaries

automated, data-driven contracting and price discovery

Why this is inevitable:

Data transparency is eliminating opacity-based arbitrage, and the rise of digital verification will force a new model for global trade flows.

Why These Zones Will Produce the Next Agri-Food & Water Unicorns

Across the WEF, Deloitte, and McKinsey outlooks, three forces consistently accelerate early-stage scaling:

1. Regulation is accelerating category creation

Compliance is becoming a market-maker.

2. Climate volatility is forcing immediate adaptation

Innovation is no longer optional; it is existential.

3. AI has collapsed time-to-build

What once took years now takes months — enabling founders to move at unprecedented speed.

This is why companies founded in these spaces will reach unicorn scale in under five year

Funding the Next Breakthrough in Agri-Food & Water

Agri-Food and Water’s next wave of category-defining companies will not emerge randomly.

They will arise where structural pressure, technology curves, and network-driven dynamics converge — exactly within the six opportunity spaces outlined above.

These spaces are not speculative.

They are the predictable outcomes of how the Agri-Food and Water systems are being rebuilt in real time.

The companies that enter these spaces will scale faster than any previous generation, become essential infrastructure for global food and water security, and reshape how the world grows, moves, and consumes food and water.