Maritime Is the Next Frontier for Billion-Dollar Technology Platforms

How the Intelligence Layer of Global Trade Is Being Rebuilt (2025–2030)

Why We’re Writing This Series

Foundational industries like Maritime are often overlooked by technology founders.

They are seen as asset-heavy, slow-moving, regulated, and difficult to engage.

That perception has historically been correct.

But it is now outdated.

The Investigate Industry Insights series exists to identify moments when essential industries cross a threshold — when structural forces align in a way that makes them venture-scale for the first time.

This first Maritime insight is deliberately outside-in.

It synthesises thousands of external sources — industry research, regulatory frameworks, policy signals, and market data — to understand where structural value is forming.

In subsequent articles, we will go deeper:

Working with domain experts to add inside-out perspectives

Collaborating with founders to explore how industry assets can be recombined

Identifying where innovation can move beyond optimisation into new, uncontested markets

Maritime Is Now Ready

For decades, the Maritime industry was structurally unsuitable for billion-dollar technology companies.

Fragmented stakeholders, analogue processes, limited data availability, and regulation designed for physical assets made it difficult to build scalable, defensible platforms. Innovation focused on incremental optimisation — not category creation.

That has now changed.

A convergence of geopolitical volatility, decarbonisation mandates, regulatory digitalisation, and data availability is forcing the industry to rebuild its information layer.

For the first time, maritime supply chains face constraints that cannot be solved with assets alone.

The conditions required for billion-dollar technology platforms — urgency, regulation, data density, global scale, and multi-stakeholder coordination — are now in place.

The Intelligence Layer of Global Trade Is Being Rebuilt (2025–2030)

For most of the modern era, maritime supply chains were the silent infrastructure of the global economy. Goods were ordered, ships crossed oceans, ports operated — and the system absorbed shocks largely out of sight.

That era is over.

Global shipping — responsible for 80–90% of world trade by volume — is now structurally fragile. Geopolitical conflict, climate volatility, regulatory mandates, and outdated information systems have converged into systemic risk.

At the same time, the digital layer that should coordinate ships, ports, cargo, compliance, and capital remains fragmented, analogue, and decades behind other global infrastructure sectors such as aviation, energy, and finance.

This mismatch — between maritime’s centrality and its digital immaturity — is creating the largest intelligence opportunity in global logistics in half a century.

The companies that build this intelligence layer between 2025 and 2030 will become the next generation of billion-dollar technology platforms.

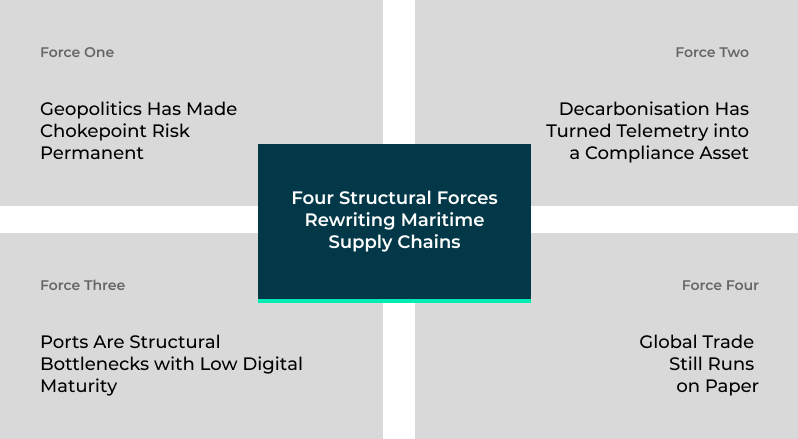

1. Four Structural Forces Rewriting Maritime Supply Chains

These are not trends.

They are design constraints that ensure new intelligence infrastructure will be built — regardless of market cycles.

Force 1 — Geopolitics Has Made Chokepoint Risk Permanent

Average haul distances increased from 4,831 miles (2018) to 5,245 miles (2024) as vessels reroute around conflict zones

The Red Sea, Suez Canal, Black Sea, and Panama Canal now experience persistent — not episodic — disruption

These shocks reshape freight flows, trade costs, and emissions

Maritime routing has shifted from an operational decision to a macro-economic variable.

Implication

Real-time, risk-aware route intelligence becomes foundational.

Force 2 — Decarbonisation Has Turned Telemetry into a Compliance Asset

IMO targets a 40% carbon-intensity reduction by 2030 (vs 2008)

Shipping is now included in the EU Emissions Trading System

FuelEU Maritime enforces lifecycle GHG rules

Compliance could raise logistics costs 3–7.6% by 2030 without optimisation

Implication

Every vessel becomes a real-time data generator.

Telemetry must be converted into actionable emissions intelligence.

Force 3 — Ports Are Structural Bottlenecks with Low Digital Maturity

~90% of global trade by volume passes through seaports

Port Community Systems remain unevenly adopted

Coordination still relies on phone calls, email, and siloed systems

Implication

Efficiency, resilience, and decarbonisation are impossible without shared digital coordination layers.

Force 4 — Global Trade Still Runs on Paper

Bills of Lading account for 10–30% of documentation cost

Digitalisation could unlock $6.5B in direct savings and $30–40B in new trade annually

Only ~2% of container BoLs were electronic as recently as 2022

Implication

Documentation, compliance, and traceability are becoming core digital infrastructure.

From Structural Pressure to Platform Opportunity

Taken together, these four forces do more than increase complexity — they break the existing operating model.

They cannot be solved by scale, steel, or incremental optimisation.

They require a new layer of intelligence that sits above ships, ports, and logistics assets, coordinating decisions across fragmented stakeholders in real time.

When constraints shift from physical to informational, platform economics follow.

The result is not one monolithic system, but a small number of distinct problem spaces — each with clear buyers, regulatory drivers, data cores, and the potential for network effects.

These are the zones where billion-dollar technology platforms can now be built.

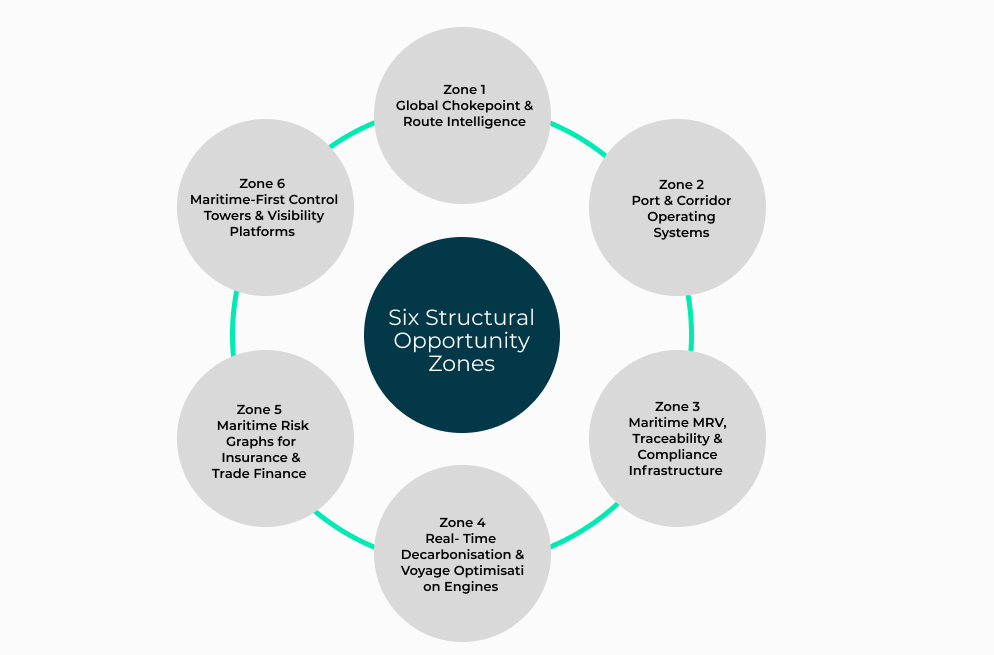

2. Six Structural Opportunity Zones

Zone 1 — Global Chokepoint & Route Intelligence

The Bloomberg Terminal for Maritime Macro-Risk

What companies will build

Real-time chokepoint risk indices

Predictive routing and ETA models

Multi-scenario simulations (cost, time, emissions)

APIs for insurers, lenders, shippers, and governments

Why it’s inevitable

Permanent volatility makes exposure-adjusted routing non-optional.

Zone 2 — Port & Corridor Operating Systems

The OS for the World’s Most Critical Trade Nodes

What companies will build

Corridor-level visibility across vessel, yard, and hinterland

Integrated port-call and berth optimisation

Carbon- and delay-minimising scheduling

Real-time public-private collaboration layers

Why it’s inevitable

Ports cannot modernise or decarbonise without shared digital infrastructure.

Zone 3 — Maritime MRV, Traceability & Compliance Infrastructure

The Digital Spine for Trade, Sanctions, and ESG

What companies will build

Electronic trade documentation and eBoLs

Embedded sanctions, KYC, and ESG lineage

Regulatory and customs interoperability

Multi-jurisdiction digital trade corridors

Why it’s inevitable

Trade cannot scale without digital trust.

Zone 4 — Real-Time Decarbonisation & Voyage Optimisation Engines

The Flight-Management System for Ships

What companies will build

Continuous MRV engines (EEXI, CII, EU ETS)

Weather- and draft-aware fuel optimisation

Carbon-liability forecasting

ESG-grade datasets

Why it’s inevitable

Climate compliance is now a real-time operational constraint.

Zone 5 — Maritime Risk Graphs for Insurance & Trade Finance

The Moody’s of Shipping Exposure

What companies will build

Entity graphs linking vessels, owners, cargo, and routes

Dark-activity detection

Compliance-adjusted risk scores

Portfolio stress-testing engines

Why it’s inevitable

Risk pricing is becoming data-driven — maritime is next.

Zone 6 — Maritime-First Control Towers & Visibility Platforms

The Missing Layer in Enterprise Supply Chains

What companies will build

Maritime-native ETA and disruption models

Port congestion and routing intelligence

Exception-management engines

Integrations with TMS, ERP, and multimodal platforms

Why it’s inevitable

Any control tower that cannot see the ocean leg clearly is incomplete.

3. Why These Zones Are Structural, Not Cyclical

Across regulation, geopolitics, climate policy, and financial markets, one conclusion repeats:

Modern global trade cannot function without real-time digital intelligence.

There is no market cycle in which these pressures disappear.

4. What Winning Companies Will Look Like

Winning platforms will be:

Data-dense and multi-source

Ecosystem-neutral

Regulatory-grade by design

Built with network-effect flywheels

Focused on narrow wedges with global expansion paths

Monetised across shipping, logistics, finance, and government

5. The Window Is Open

The forces are locked in.

The market is early.

The intelligence layer remains largely unclaimed.

This creates a five-year window (2025–2030) to build:

Durable data moats

Deep industry integration

High-margin, infrastructure-like technology platforms

This future is not uncertain.

It is already written in the structure of global trade.

The only question is who will build the intelligence systems that power it.